In the ever-evolving landscape of global business, companies are continually seeking innovative ways to expand their operations and access new markets. One such strategy involves the use of Special Purpose Vehicles (SPVs) for raising capital across borders. This blog post explores how a Chinese parent company leverages an SPV in Hong Kong to raise investment funds from US investors through bond issuance, focusing on a niche market within dental supplies.

The Role of SPVs in International Expansion

Special Purpose Vehicles (SPVs) are entities created specifically to fulfill narrow, precise objectives, often related to financial transactions like issuing bonds or managing specific assets. In our case study, the SPV is established in Hong Kong by a Chinese parent company specializing in high-quality dental supplies, aiming to expand its business scale. By setting up an SPV in Hong Kong, this dental company, let’s call it “Dental Lab Shop,” aims to tap into international investment pools, particularly targeting US investors.

Hong Kong serves as an ideal location for establishing an SPV due to its robust legal framework, transparent regulatory environment, and proximity to mainland China. Additionally, Hong Kong’s status as an international financial hub facilitates easier access to global capital markets, including those in the United States.

The Dental Supplies Market Focus

“Dental Lab Shop” primarily deals with high-quality dental supplies aimed at dentists and dental technicians. The company focuses on more dental niches, offering specialized products that cater to the unique needs of these professionals. From precision instruments to advanced materials used in dental restoration, “Dental Lab Shop” has carved out a significant niche within the dental supplies market.

However, expanding this business requires substantial investment funds. To achieve this goal, the company decided to utilize an SPV structure. Through the SPV, “Dental Lab Shop” can issue bonds to attract US investor funds. This approach not only diversifies the company’s funding sources but also mitigates risks associated with relying solely on domestic financing.

Issuing Bonds via an SPV

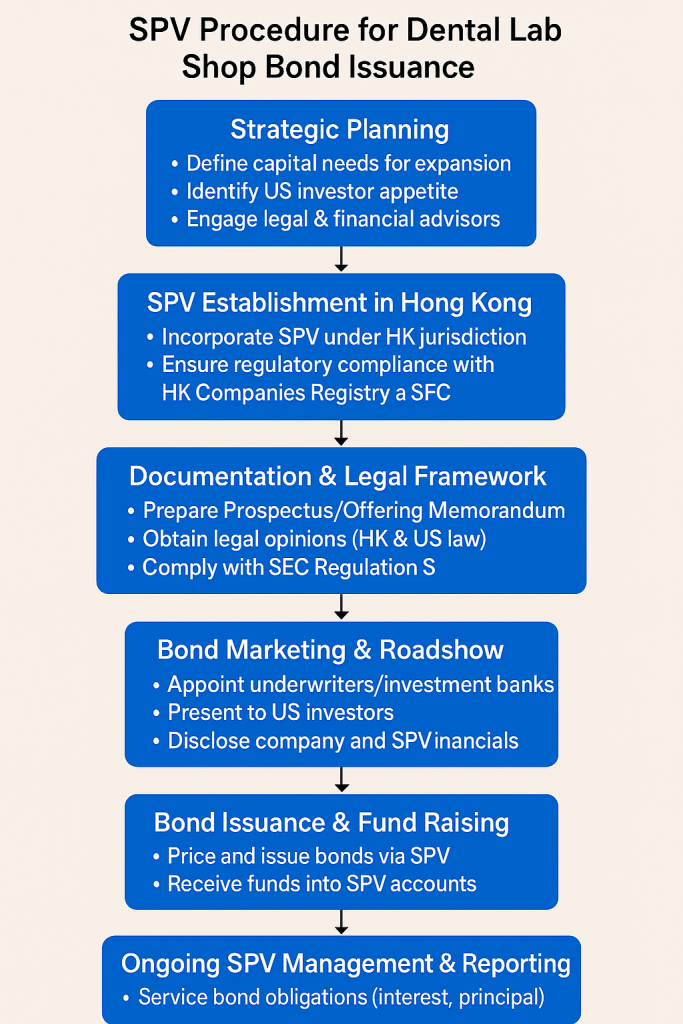

Issuing bonds through an SPV allows “Dental Lab Shop” to leverage Hong Kong’s favorable conditions for financial activities. The process involves careful planning, including selecting underwriters, preparing necessary documentation, and complying with both local and international regulations. Once the SPV is set up and approved, it can proceed with issuing bonds targeted at US investors.

The success of this endeavor hinges on several factors, including the creditworthiness of the parent company, the attractiveness of the investment proposition, and the overall health of the global economy. By issuing bonds, “Dental Lab Shop” can secure the large amount of investment funds needed to expand its product lines, enhance distribution networks, and potentially enter new markets.

Conclusion

The utilization of an SPV in Hong Kong by a Chinese parent company like “Dental Lab Shop” showcases a strategic approach to accessing international capital. This method provides a pathway for businesses focused on specialized markets, such as dental supplies, to grow beyond domestic borders. It exemplifies how leveraging international financial hubs can facilitate growth, innovation, and market expansion. As global markets continue to integrate, the role of SPVs in facilitating cross-border investments will likely become even more pivotal, enabling companies to pursue ambitious growth strategies with confidence.